How to use nudges in debt collection

3 behavioral design tactics that reduce friction and motivate payment

Key Takeaways

- Nudges can guide repayment decisions when used responsibly

- Each tactic highlights a friction point in the payment journey

Choice architecture can be guided by subtle behavioral tactics known as nudges. In debt collection, these nudges can help reduce friction—and make payment feel easier and more doable.

Each of the following tactics addresses a different aspect of decision-making and helps collections teams present payment options in ways that feel intuitive, manageable, and easy to act on.

1. Incentives: Frame Repayment as a Smart Financial Move

People are more likely to act when they see a direct benefit—not just a consequence of inaction. Traditional collections outreach often relies on penalties to trigger action—but when framed positively, the same behavioral principle, loss aversion, can motivate repayment without pushing customers into avoidance.

When Jamie falls behind on his credit card payment, he could receive one of the following messages:

The second message frames repayment as a way to maintain financial stability, tapping into Jamie's motivation to protect his credit. Instead of pushing him further into avoidance, it gives him a reason to act now.

2. Defaults: Make the Easiest Choice the Right Choice

People often stick with default options due to status quo bias, which makes us favor the recommended or pre-selected choice as the baseline. In debt collection, strategically pre-selecting a payment option can reduce decision fatigue and increase follow-through.

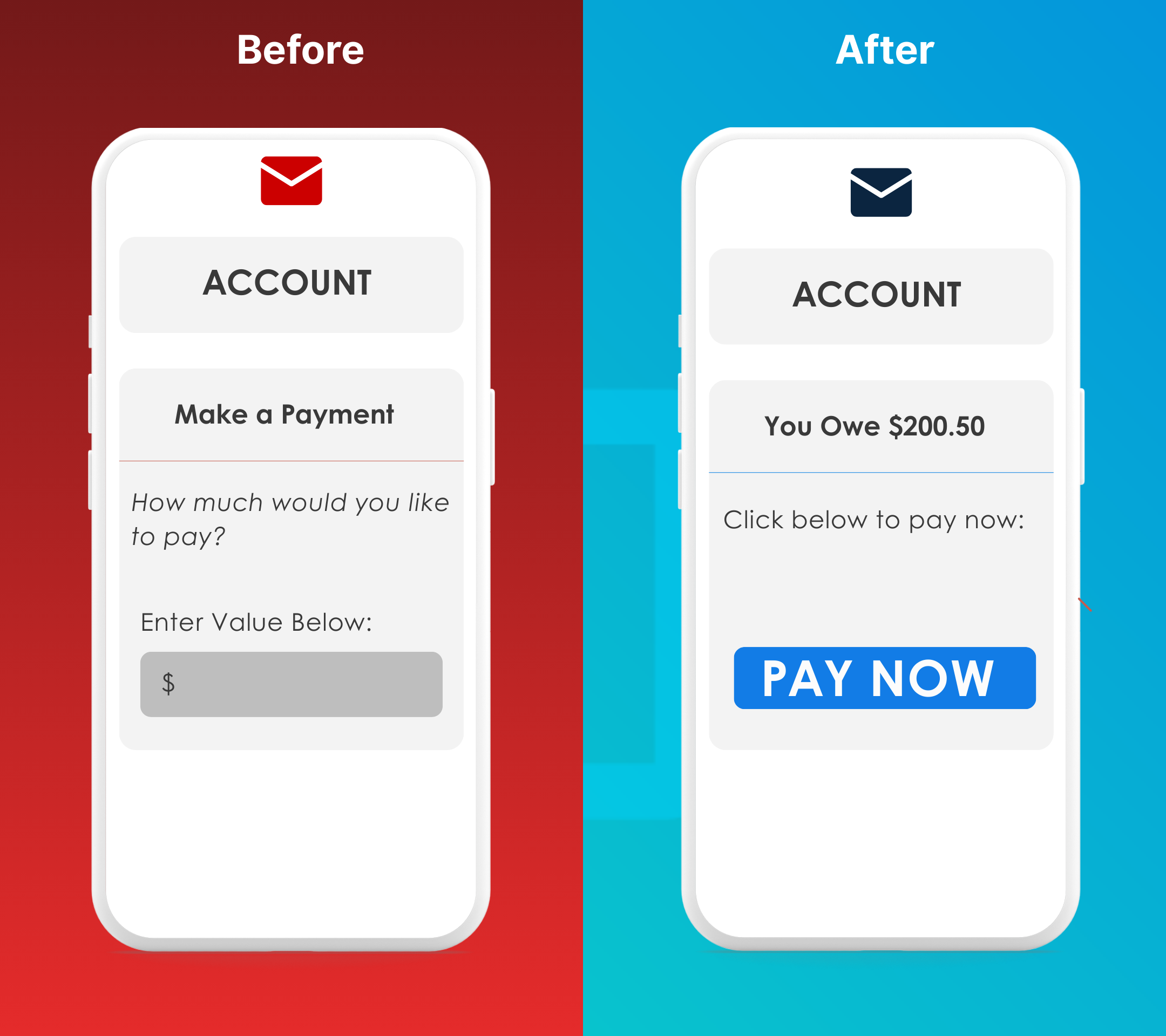

Jamie logs into their account to make a payment and is presented with a screen asking, "How much would you like to pay?" with an empty field to fill in. Uncertain about the best amount, they first check their outstanding balance and then review their available funds to gauge what they can afford. In the process, they may recall other upcoming bills or financial obligations, which adds to their hesitation. At the same time, external interruptions—such as a text message, phone call, or other distractions—can further disrupt the task, leading Jamie to abandon the payment before completing it.

However, if Jamie sees a payment screen with a pre-determined due amount and a one-click "Pay now" button, there's far less friction, which makes it easier for them to take action.

By thoughtfully setting defaults, we can increase repayment rates while maintaining customer autonomy.

3. Give Feedback: Reinforce Positive Repayment Behavior

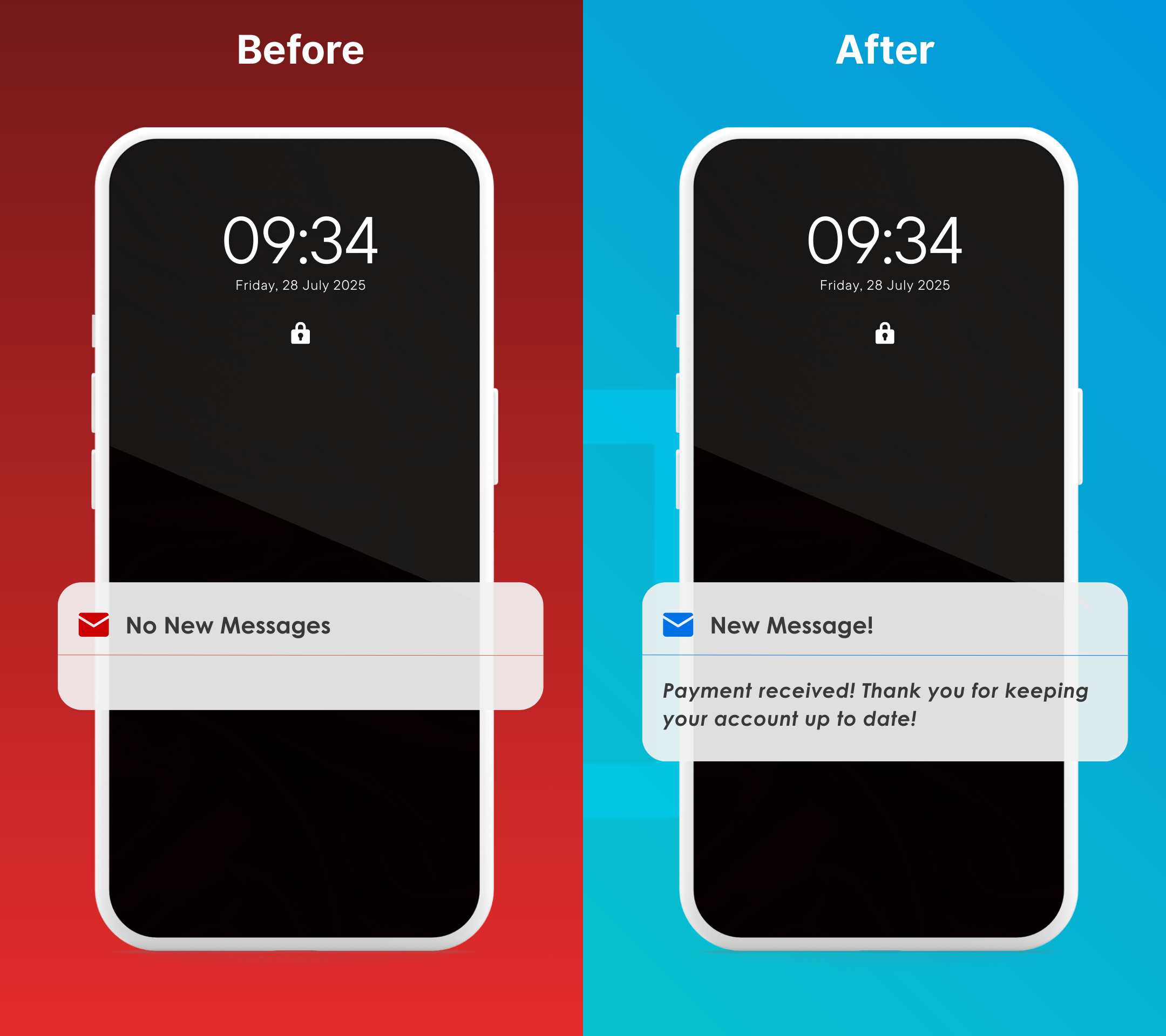

When past-due customers make a payment, they need immediate, clear feedback to reinforce their decision and encourage them to repeat the positive action in the future. Without feedback, they may feel uncertain about whether their payment was received or how it impacts their financial situation, often prompting unnecessary actions such as calling to confirm—wasting both the consumer's time and adding avoidable costs for the provider.

After submitting a payment, Jamie expects confirmation but receives no immediate response. He starts to wonder, "Did the payment go through?"

Now, imagine a better experience. Immediately after paying, Jamie receives a confirmation message: "Payment received! Thank you for keeping your account up to date!"

This tailored outreach not only acknowledges the completion of a financial obligation but also positions the company as a supportive partner, invoking a response to reciprocate this positive action. When customers perceive that their efforts are recognized and valued, they are more likely to respond in kind, demonstrating increased loyalty and a proactive approach to future interactions.

The Real Question Nudges in Collections Leave Us With

While nudging provides a valuable framework for surfacing friction points and creating more intuitive customer experiences, it isn't a silver bullet for debt recovery. The central challenge is not simply identifying which nudges are possible but determining how and when to apply them responsibly.

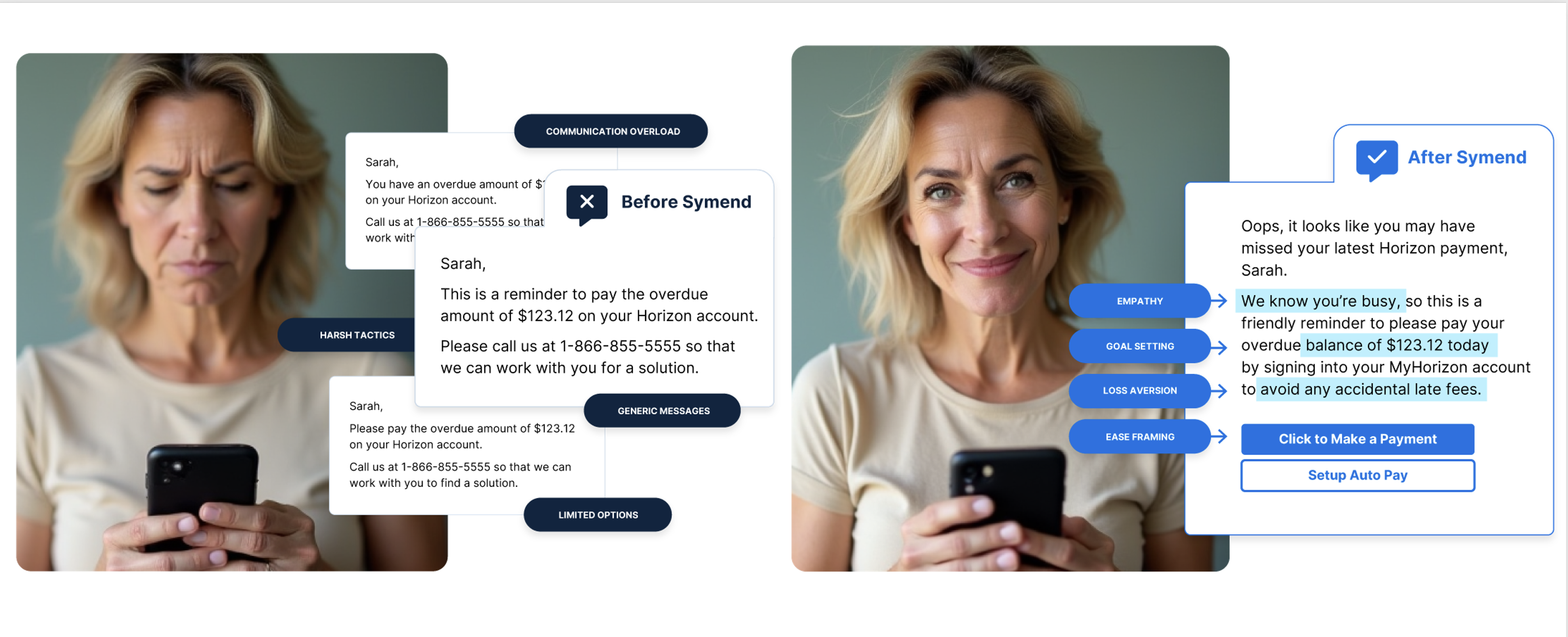

This is where SymendCure offers a genuine advantage. Unlike traditional, one-size-fits-all strategies, Symend uses behavioral science and AI to understand what motivates each customer. Its approach goes beyond surface level reminders, using proprietary data and psychological archetypes to predict behavior, segment audiences, and deliver timely, hyper-personalized engagement journeys—whether for financial services, telecommunications, or utility providers.

Symend's platform generates tailored, customer-centric messages that are sent at the right time, in the right way—continually learning from real interactions to refine strategies and drive higher recovery rates and lower operational costs. As uncertainty and delinquency rates rise, this tailored, customer-centric approach empowers you to address the real drivers of repayment, and to treat customers as people, not just accounts.

A Note on the Term "Nudge": You've probably seen the term nudge used in behavioral economics to describe subtle design cues that guide decisions. While the concept remains widely used in business, some academics have raised concerns about the real-world impact and scientific foundations of nudge-based interventions and the integrity of the research that first popularized it. In this blog, we've used nudge in its broad, widely understood sense—as a practical way to describe behavioral tactics that can influence repayment behavior—not as an endorsement of any specific academic framework.

Frequently Asked Questions

What are nudges in debt collection?

Nudges in debt collection are subtle prompts based on behavioral science that encourage past-due customers to take action without being coercive. They use psychological principles like social proof, loss aversion, and framing to guide customers toward repayment decisions that benefit both them and the business.

How effective are behavioral nudges for debt recovery?

Behavioral nudges can increase debt recovery rates by 10% or more when properly implemented. They work by reducing psychological friction and helping customers overcome decision paralysis, making it easier for them to commit to payment plans while maintaining positive relationships.

What are examples of nudges in collections?

Common nudges include default payment options (pre-selecting recommended payment amounts), deadline prompts (creating urgency), social proof (showing that others in similar situations paid), and progress indicators (showing customers their path to account resolution). These subtle cues significantly improve engagement and payment rates.

Are nudges ethical in debt collection?

Yes, when used properly. Ethical nudges help customers make better financial decisions by reducing confusion and anxiety, not by manipulation. They should always preserve customer autonomy, provide clear information, and align with compliance requirements like FDCPA and CFPB regulations.