By combining behavioral science with AI to take engagement further than simple nudges, Symend helps auto lenders recover more delinquent loans while preserving customer relationships and reducing repossession costs

Poor recovery rates

Poor recovery rates High operation costs

High operation costs Erosion in trust & loyalty

Erosion in trust & loyalty

+10% recovery rates

+10% recovery rates -50% OpEx costs

-50% OpEx costs Improved customer trust & LTV

Improved customer trust & LTVDelinquent accounts quadrupled in one year, overwhelming collections teams while generic messaging was dismissed as spam by customers unfamiliar with the servicer brand.

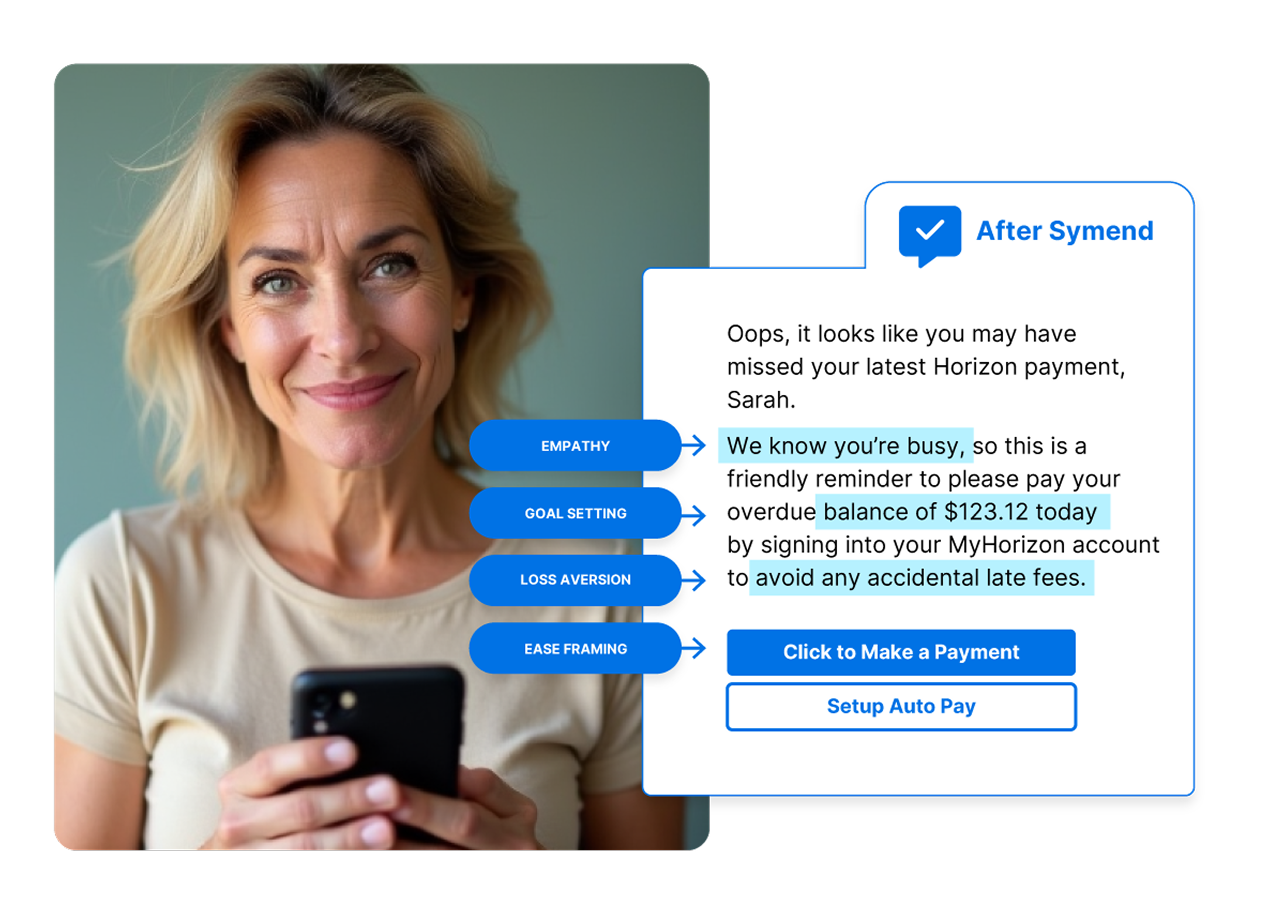

AI-driven behavioral engagement with personalized, non-judgmental messaging and self-service payment links tailored to each customer's archetype and capacity to pay.

27% of customers self-cured via email links, 80% reduction in outbound calls.

Customers who cure often fall back into delinquency within months, creating a costly cycle of repeated collection efforts and eroding customer lifetime value.

Post-cure nurture programs using predictive modeling to identify at-risk customers and loop them into auto-pay enrollment with behavioral science-optimized messaging.

35% reduction in repeat delinquencies, increased auto-pay adoption rates.

Subprime auto loan delinquency rates exceeding 6%, with traditional punitive collections messaging driving customer disengagement and higher opt-out rates.

Empathetic, customer-centric outreach using behavioral personas to match messaging to each customer's situation, emphasizing solutions over consequences.

60% response rate, improved customer satisfaction and Google reviews.

As call volumes skyrocketed and customer uncertainty continued to rise - having Symend as a trusted partner allowed us to continue to provide outstanding customer service and build stronger relationships with our customers."

Kim Vey | Director, Client Operations at TELUS

Symend is proven to deliver over 10x ROI. Get your custom report on how we can improve cure rates, LTV & reduce OpEx costs for your unique business today.

Get Free ROI Report

Unpack some of our most commonly asked questions.

Don't see what you're looking for? Speak to our team today.

Symend's AI-driven platform delivers up to 10% higher recovery rates by identifying at-risk borrowers early and engaging them with hyper-personalized messaging before delinquencies escalate. Using Delinquency Archetypes and behavioral science, Symend's AI predicts borrower behavior and generates optimized engagement flows that drive repayment action—reducing roll rates while maintaining positive customer relationships. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, Symend transforms collections from reactive pursuit to proactive engagement.

Auto finance presents unique challenges: secured assets create repossession complexities, subprime borrowers face higher income volatility, and 30+ day delinquency rates have risen to 15.6%. Symend's AI addresses these industry-specific dynamics by combining behavioral science with real-time optimization across four levels—scoring, segmentation, messaging, and journey iteration. Unlike generic collections tools, Symend's platform understands auto borrower psychology and delivers personalized engagement that balances regulatory compliance, customer retention, and recovery performance.

Symend's AI determines each borrower's journey using Delinquency Archetypes and behavioral insights—decoding whether someone forgot a payment, is experiencing temporary hardship, or feels overwhelmed by their situation. The platform then generates hyper-personalized engagement with embedded behavioral science tactics proven to work best with each borrower's profile. This AI-driven approach delivers the right message, through the right channel, at the right time—resulting in 60%+ response rates and 27% self-cure rates for auto lenders.

Symend requires minimal data to get started—as few as 12 fields in a flat file. The platform has invested heavily in data ingestion and normalization technology, making onboarding low-friction without requiring extensive IT resources. Symend scales from simple flat files to multiple data sources and real-time API integrations with common Loan Management Systems, delivering rapid time-to-value without disrupting existing servicing infrastructure or origination workflows.

Symend integrates built-in compliance safeguards into all engagement strategies, ensuring communications meet regulatory standards across North America and the UK—including CFPB and state requirements in the US, FCA Consumer Duty in the UK, and provincial regulations in Canada. The platform's audit-ready approach includes consent management, quiet hours enforcement, and documentation of every customer interaction. Symend's behavioral science methodology aligns with regulatory emphasis on fair treatment and vulnerable customer protection—reducing complaints while improving recovery outcomes.

Subprime auto loans face delinquency rates exceeding 10%, requiring different engagement strategies than prime portfolios. Symend's AI segments borrowers using 39 behavioral personas tailored to subprime customer psychology, delivering empathetic messaging that acknowledges financial stress without punitive language. This approach drives 8-10% recovery lift versus traditional collections while reducing complaints and opt-outs—helping lenders protect margins in portfolios where loan loss allowances have increased to 12.8%.

Symend reduces repossessions by intervening earlier in the delinquency cycle with AI-optimized engagement flows that drive repayment action before accounts escalate to asset recovery. By connecting at-risk borrowers with payment arrangements, hardship programs, and flexible options through self-service tools, Symend helps lenders avoid the operational costs, customer relationship damage, and regulatory scrutiny associated with vehicle repossession—while preserving customer lifetime value and future refinancing opportunities.

Auto lenders managing millions of accounts need scalable solutions that reduce cost-to-collect. Symend's AI-driven automated outreach delivers 85% reduction in agent interactions and 50% reduction in OpEx costs—making efficient engagement across large portfolios economically viable. Self-service payment tools allow borrowers to resolve delinquencies independently, freeing call center resources for complex situations while Symend's single interconnected system continuously optimizes to drive incremental value at scale.

Symend starts with a 90-day pilot that can be implemented in weeks, not months. The AI model begins training after the first 24 hours of borrower data ingestion, with cohort performance reviews at 40-day and 80-day intervals. Upon pilot completion, clients receive full analysis, breakdown of monetary impact, and next steps to ramp to production volume. Professional services with collections and behavioral science expertise are included, delivering white-glove implementation with continuous optimization.

Symend delivers proven 10x ROI through multiple value streams: up to 10% higher recovery rates, 85% reduction in agent interactions, 50% reduction in OpEx costs, improved roll rates, and reduced third-party collection fees. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, auto lenders see millions in additional recovered revenue while strengthening borrower relationships. Symend operates on a consumption-based SaaS pricing model—all professional services included with no hidden fees.