Symend's AI-powered platform helps utility providers reduce delinquencies, minimize service disconnections, and recover more revenue—while maintaining the positive customer relationships essential to your business

Poor recovery rates

Poor recovery rates High operation costs

High operation costs Erosion in trust & loyalty

Erosion in trust & loyalty

+10% recovery rates

+10% recovery rates -50% OpEx costs

-50% OpEx costs Improved customer trust & LTV

Improved customer trust & LTVCold weather drives 300% increase in customer calls during peak heating season, overwhelming call centers and delaying collections.

Proactive behavioral engagement identifies at-risk customers before bills escalate, offering payment arrangements and budget billing options.

45% reduction in customer service calls, improved payment arrangements.

Extreme heat drives unexpected "bill shock" as A/C costs spike, causing delinquency surges and service disconnections.

AI-driven behavioral engagement identifies customers likely to struggle before high bills arrive, offering flexible payment options proactively.

60% increase in payment plan enrollment, improved customer satisfaction.

Economic pressures push previously reliable customers into delinquency for the first time, requiring different engagement strategies.

Behavioral science segments customers by capacity and willingness to pay, delivering empathetic, personalized outreach with tailored payment solutions.

Maintained customer relationships while recovering 90% of delinquent amounts.

How one of the largest US utilities is modernizing collections with Symend's AI-driven behavioral engagement.

As call volumes skyrocketed and customer uncertainty continued to rise - having Symend as a trusted partner allowed us to continue to provide outstanding customer service and build stronger relationships with our customers."

Kim Vey | Director, Client Operations at TELUS

Symend is proven to deliver over 10x ROI. Get your custom report on how we can improve cure rates, LTV & reduce OpEx costs for your unique business today.

Get Free ROI Report

Unpack some of our most commonly asked questions.

Don't see what you're looking for? Speak to our team today.

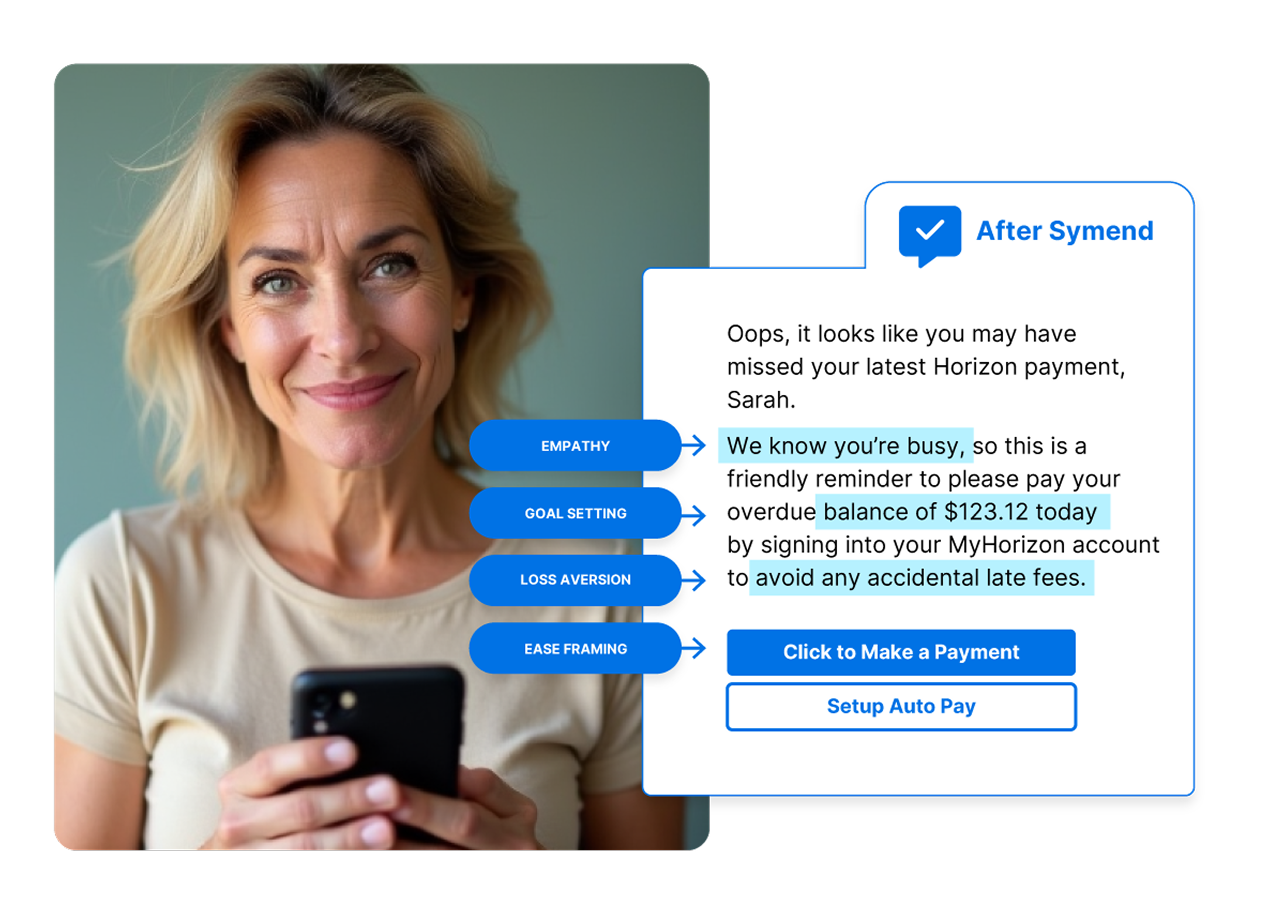

Symend's AI-driven platform delivers up to 10% higher recovery rates by identifying at-risk customers early and engaging them with hyper-personalized messaging before situations escalate to disconnection. Using Delinquency Archetypes and behavioral science, Symend's AI predicts customer behavior and generates optimized engagement flows that drive repayment action - reducing involuntary disconnections while maintaining positive customer relationships. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, Symend transforms disconnection risk into retention opportunity.

Utility debt collection presents unique challenges: essential services cannot be repossessed, regulatory bodies impose strict customer protection rules, and utilities face seasonal delinquency peaks. Symend's AI addresses these industry-specific dynamics by combining behavioral science with real-time optimization across four levels - scoring, segmentation, messaging, and journey iteration. Unlike generic collections approaches, Symend's platform understands utility customer behavior patterns and delivers personalized engagement that balances regulatory compliance, customer vulnerability, and recovery performance.

Symend's AI determines each customer's journey using Delinquency Archetypes and behavioral insights - decoding whether someone forgot, is having a tough month, or feels overwhelmed. The platform generates hyper-personalized engagement through email, text, IVR, and letter delivery with embedded behavioral science tactics. Symend empowers customers to self-cure through payment options like autopay and payment arrangements, nurturing each customer based on their unique engagement patterns and dynamically optimizing based on real-time signals to maximize results.

Yes, Symend integrates seamlessly with existing collections systems and standard operating procedures. The platform requires minimal data - as few as 12 fields in a flat file - and can ingest from any source including CRMs, risk scoring systems, and core utility Customer Information Systems through robust APIs and pre-built connectors. Symend offers full orchestration of email, text, IVR, and letter delivery through the platform or leverages a client's in-house tools, delivering rapid time-to-value without disrupting existing billing infrastructure.

Symend employs an enterprise-level data security framework including data minimization, anonymization, and encryption to protect sensitive customer information. The platform integrates built-in compliance safeguards into all engagement strategies, ensuring communications meet state Public Utility Commission requirements, FDCPA guidelines, and consumer protection standards including SOC 2, GDPR, ISO, and CCPA. Symend automatically respects disconnection moratorium rules, vulnerable customer protections, and required payment plan disclosures across jurisdictions.

Symend's AI decodes human behavior to understand the actual story behind late payments - identifying customers experiencing financial hardship and tailoring engagement accordingly. The platform connects at-risk customers with appropriate payment arrangements, assistance programs, and flexible options before situations become unmanageable. By treating debt as a shared human experience and using behavioral science to empower rather than pressure, Symend helps utilities support vulnerable populations while meeting regulatory expectations for customer-centric service.

Symend reduces utility bad debt by engaging customers earlier in the delinquency cycle with AI-optimized engagement flows that drive repayment action before accounts become uncollectible. With up to 10% higher recovery rates, improved write-off rates, and faster time-to-cure, Symend minimizes accounts requiring write-off or petition for general rate recovery. Across 250+ million delinquencies and $50B+ in recoveries, Symend's AI and behavioral science approach delivers proven 10x ROI.

Utility companies typically manage large numbers of relatively small unpaid bills, making traditional collections cost-prohibitive. Symend's AI-driven automated outreach delivers 85% reduction in agent interactions and 50% reduction in OpEx costs - making recovering smaller balances economically viable. Self-service payment tools allow customers to resolve overdue bills independently, freeing call center resources for complex situations while Symend's single interconnected system continuously optimizes to drive incremental value.

Symend starts with a 90-day pilot that can be implemented in weeks, not months. The AI model begins training after the first 24 hours of customer data ingestion, with cohort performance reviews at 40-day and 80-day intervals. Upon pilot completion, clients receive full analysis, breakdown of monetary impact, and next steps to ramp to production volume. Professional services with collections and behavioral science expertise are included, delivering white-glove implementation with continuous optimization.

Symend delivers proven 10x ROI through multiple value streams: up to 10% higher recovery rates, 85% reduction in agent interactions, 50% reduction in OpEx costs, decreased text/email/letter costs, improved write-off rates, and reduced third-party fees. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, utility clients see millions in additional recovered revenue while strengthening customer relationships. Symend operates on a consumption-based SaaS pricing model - all professional services included with no hidden fees.