Symend's AI-powered platform helps credit unions recover more while preserving member relationships—delivering enterprise-level collections capabilities with the empathy and personalization your members expect

Poor recovery rates

Poor recovery rates High operation costs

High operation costs Erosion in trust & loyalty

Erosion in trust & loyalty

+10% recovery rates

+10% recovery rates -50% OpEx costs

-50% OpEx costs Improved customer trust & LTV

Improved customer trust & LTVTraditional collections tactics conflict with credit union cooperative values, risking member trust and long-term loyalty when pursuing past-due accounts.

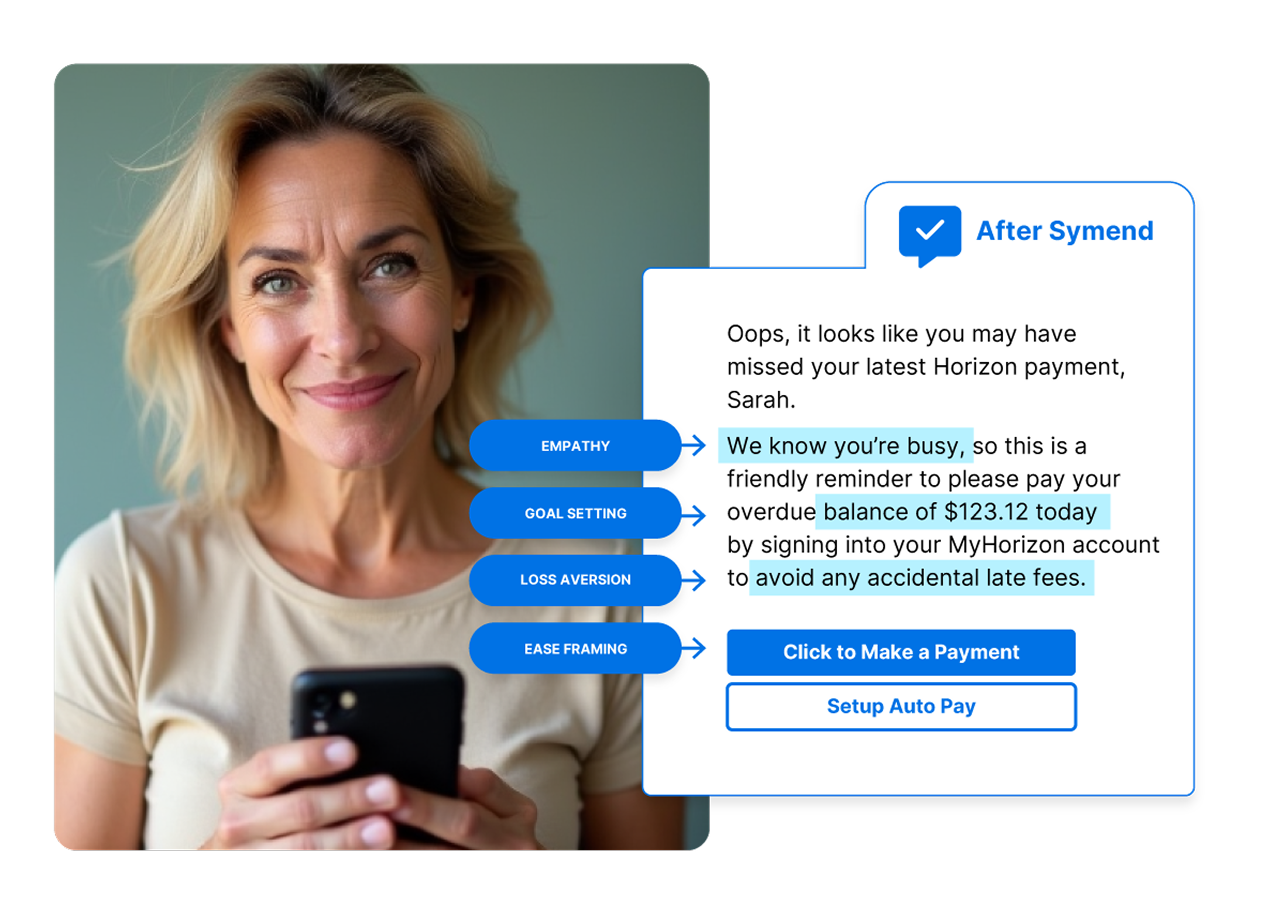

Empathy-driven behavioral engagement with member-centered messaging that transforms at-risk accounts into positive interactions, offering support and solutions rather than punitive demands.

Up to 10% improvement in recovery rates while strengthening member satisfaction and loyalty.

Lean credit union budgets can't sustain manual collections processes, yet members expect personalized service that large-scale automation typically sacrifices.

AI-powered automated journeys deliver hyper-personalized outreach at scale, minimizing manual interventions while preserving the member-friendly approach credit unions are known for.

50% reduction in OpEx costs, 85% reduction in agent interactions.

Members who experience negative collections interactions often leave the credit union entirely, eroding the membership base and lifetime value.

Proactive engagement identifies at-risk members before they fall behind, connecting them with assistance programs and flexible payment options rather than waiting to collect on delinquent accounts.

Reduced member churn, increased lifetime value, improved Net Promoter Scores.

As call volumes skyrocketed and customer uncertainty continued to rise - having Symend as a trusted partner allowed us to continue to provide outstanding customer service and build stronger relationships with our customers."

Kim Vey | Director, Client Operations at TELUS

Symend is proven to deliver over 10x ROI. Get your custom report on how we can improve cure rates, LTV & reduce OpEx costs for your unique business today.

Get Free ROI Report

Unpack some of our most commonly asked questions.

Don't see what you're looking for? Speak to our team today.

Symend's AI-driven platform delivers up to 10% higher recovery rates through empathy-driven engagement that aligns with credit union cooperative values. Using Delinquency Archetypes and behavioral science, Symend transforms collections from adversarial pursuit into supportive outreach—helping members resolve past-due balances while preserving the trust that defines the credit union relationship. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, Symend enables credit unions to recover more without sacrificing member loyalty.

Credit unions face unique collections challenges: member-owned cooperative structures prioritize relationships over profit, leaner budgets limit technology investment, and community reputation depends on how members are treated during financial hardship. Symend's AI addresses these dynamics with member-centered messaging that offers solutions rather than demands, preserving the personalized service credit unions are known for while delivering the operational efficiency typically associated with larger institutions.

Symend's AI determines each member's journey using Delinquency Archetypes and behavioral insights—understanding whether someone forgot a payment, is experiencing temporary hardship, or needs connection to member assistance programs. The platform generates hyper-personalized engagement with embedded behavioral science tactics proven to resonate with each member's situation. This approach delivers the right message, through the right channel, at the right time—achieving 55%+ open rates and 36%+ click rates for credit union communications.

Yes, Symend integrates seamlessly with existing credit union core banking systems and standard operating procedures. The platform can ingest data from any source—including core systems, CRMs, risk scoring, and dialer files—through robust APIs and pre-built connectors. Symend requires minimal data to start (as few as 12 fields) and offers full orchestration of email, text, IVR, and letter delivery through the platform or your in-house tools.

Symend integrates built-in compliance safeguards into all engagement strategies, ensuring communications meet regulatory standards—including NCUA requirements in the US and provincial regulations in Canada. The platform's audit-ready approach includes consent management, contact frequency limits, and documentation of every member interaction. Symend's behavioral science methodology aligns with regulatory emphasis on fair treatment of members experiencing financial difficulty—reducing complaints while improving recovery outcomes and protecting credit unions from compliance risk.

Symend's platform connects members facing financial difficulty with appropriate resources—including payment arrangements, forbearance agreements, and member assistance programs—before situations become unmanageable. By treating financial hardship as a shared challenge and using behavioral science to empower rather than pressure, Symend helps credit unions support vulnerable members while meeting both regulatory expectations and cooperative principles. The approach reduces charge-offs while strengthening the member relationships that define credit union identity.

Symend reduces credit union charge-offs by engaging members earlier in the delinquency cycle with AI-optimized engagement flows that drive repayment action before accounts become uncollectible. With up to 10% higher recovery rates, improved roll rates, and faster time-to-cure, Symend minimizes accounts requiring charge-off. Across 250+ million delinquencies and $50B+ in recoveries, Symend's behavioral science approach delivers proven 10x ROI while maintaining the member-first philosophy central to credit union operations.

Credit unions typically operate with leaner resources than large banks, making efficient collections critical. Symend's AI-driven automated outreach delivers 85% reduction in agent interactions and 50% reduction in OpEx costs—providing enterprise-level engagement capabilities without enterprise-level investment. As a fully managed service, Symend allows credit unions to leverage cutting-edge technology and behavioral science expertise without extensive internal resources or IT infrastructure, making sophisticated collections accessible regardless of credit union size.

Symend starts with a 90-day pilot that can be implemented in weeks, not months. The AI model begins training after the first 24 hours of member data ingestion, with cohort performance reviews at 40-day and 80-day intervals. Upon pilot completion, credit unions receive full analysis, breakdown of monetary impact, and next steps to ramp to production volume. Professional services with collections and behavioral science expertise are included, delivering white-glove implementation tailored to credit union needs.

Symend delivers proven 10x ROI through multiple value streams: up to 10% higher recovery rates, 85% reduction in agent interactions, 50% reduction in OpEx costs, improved roll rates, and reduced charge-offs. With 9+ years treating 250+ million delinquencies and $50B+ in recoveries, credit unions see meaningful improvements in collections performance while strengthening member relationships. Symend operates on a consumption-based SaaS pricing model—all professional services included with no hidden fees—making advanced collections technology accessible for credit unions of all sizes.